Most crypto holders underestimate the importance of operational security (OPSEC)</strong) in safeguarding their digital assets. A hardware wallet offers a significant layer of protection against hacks, but without the right practices, users can expose themselves to serious threats. Employing effective OPSEC measures can help mitigate risks such as phishing attacks and physical theft, ensuring that your cryptocurrency remains secure. By understanding common vulnerabilities and implementing best practices, you can enhance your security posture and maintain the integrity of your investments.

Understanding Hardware Wallets

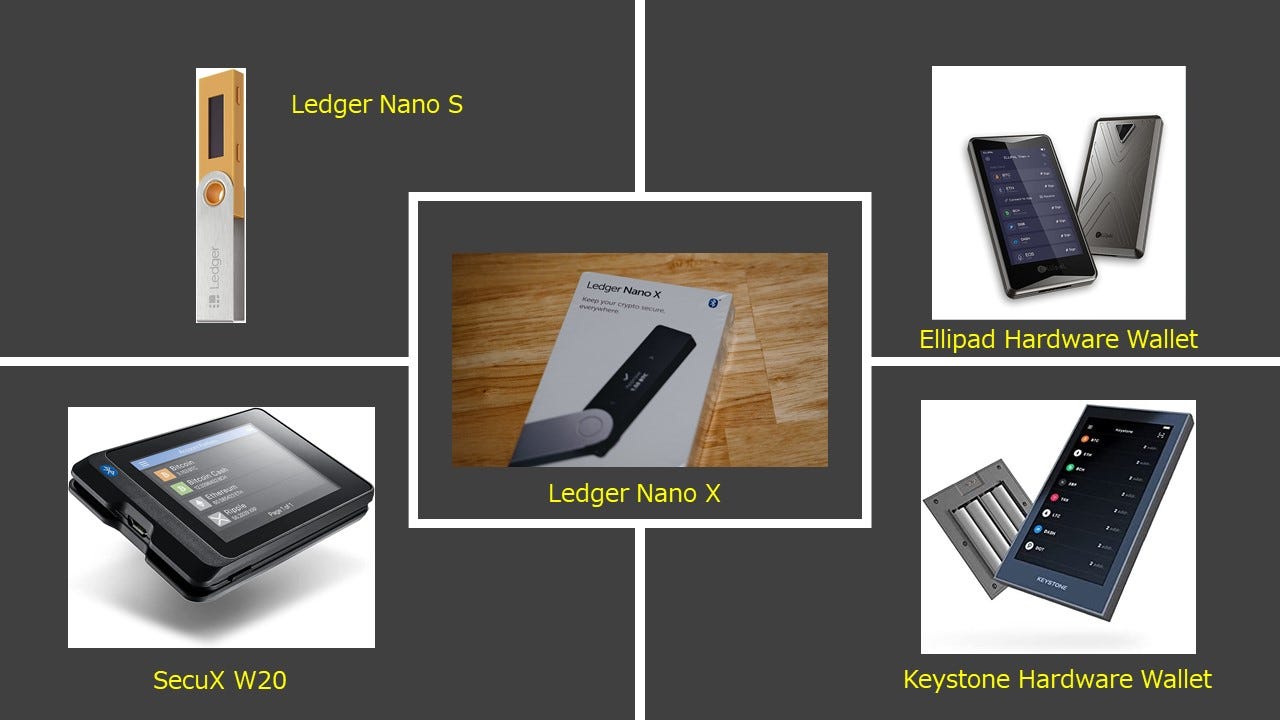

Before plunging into the specifics of hardware wallets, it’s imperative to grasp their fundamental role in the cryptocurrency ecosystem. They are physical devices designed to securely store private keys, which are necessary for accessing and managing your cryptocurrencies. Unlike software wallets, which can be more vulnerable to online threats, hardware wallets isolate your keys in a secure environment, significantly reducing the risk of malware and hacking attempts.

What is a Hardware Wallet?

The concept of a hardware wallet revolves around providing a robust layer of security for crypto assets. These devices typically resemble USB drives and operate offline, allowing users to create, sign, and send transactions without exposing private keys to the internet. This offline functionality makes them a preferred choice among crypto holders who prioritize security over convenience.

Benefits of Using Hardware Wallets

Any approach to storing cryptocurrencies should consider the use of hardware wallets for their impressive security features. They are less susceptible to cyber attacks because they keep private keys offline, effectively preventing unauthorized access. Additionally, many hardware wallets offer advanced encryption and backup options, ensuring users can recover their assets in case the device is lost or damaged.

Further enhancing their appeal, hardware wallets often support multiple cryptocurrencies and have user-friendly interfaces, making them accessible to both beginners and experienced users. With their ability to mitigate online threats while providing a secure storage environment, these wallets are considered a wise investment for safeguarding digital assets. Moreover, the peace of mind they offer by safeguarding your assets against potential loss and theft cannot be overstated.

Importance of Operational Security (OPSEC)

If you are a cryptocurrency holder, understanding the importance of operational security (OPSEC) is necessary for protecting your digital assets. The rise in popularity of cryptocurrencies has attracted not only investors but also malicious actors seeking to exploit vulnerabilities. Without proper OPSEC measures in place, crypto holders may inadvertently expose their assets to a wide range of threats, leading to financial loss.

If you want to safeguard your investments, implementing strong OPSEC practices can make a significant difference in how secure your holdings are. This includes being aware of the risks associated with digital wallets, public information sharing, and device security. Ultimately, a solid OPSEC framework enables crypto users to better navigate the complexities of the digital currency landscape.

Defining OPSEC in the Crypto Space

OPSEC involves a series of practices designed to protect sensitive information from falling into the wrong hands. In the crypto space, it specifically refers to safeguarding personal and financial data related to cryptocurrency assets. This includes securing private keys, encryption methods, and online interactions to mitigate potential risks from external threats.

Effective OPSEC requires a proactive approach. Crypto holders must prioritize using hardware wallets, secure internet connections, and anonymizing tools to prevent unauthorized access to their digital assets. Understanding the significance of OPSEC in this rapidly evolving environment is vital for maintaining control over one’s cryptocurrency portfolio.

Common Threats to Crypto Holders

Along with its advantages, the cryptocurrency market presents various threats that can jeopardize the security of holders. These include phishing scams, malware attacks, and social engineering tactics employed by cybercriminals to gain access to your assets. Failure to recognize these threats can lead to significant financial losses as hackers continually develop more sophisticated methods to breach security.

To combat these threats, it is imperative for crypto holders to stay informed about the latest scam tactics and to implement layered security measures, such as two-factor authentication and regular software updates. Additionally, being cautious about where and how you share information online can drastically reduce your vulnerability. By adopting comprehensive OPSEC strategies, you can enhance the safety of your cryptocurrency investments and minimize the likelihood of becoming a target.

Best Practices for Hardware Wallet OPSEC

There’s a need for diligent practices when it comes to the secure setup and configuration of your hardware wallet. First and foremost, always perform the initial setup in a secure environment, free from surveillance and potential threats. Avoid using public Wi-Fi networks; instead, utilize a trusted and private internet connection. During the configuration process, ensure that the recovery seed is generated in a disconnected state to prevent any malware from capturing sensitive information. Storing this recovery seed securely is paramount; consider using a fireproof and waterproof safe to protect it from physical damage.

Secure Setup and Configuration

After establishing your hardware wallet, customize the settings to enhance your security posture. Enable any available features such as passphrase protection for additional layers of security beyond the recovery seed. Regularly check the wallet’s settings and configurations to ensure they align with industry best practices, including disabling unnecessary features that may expose your device to risks.

Regular Firmware Updates

Around the evolving landscape of cybersecurity, it is imperative to maintain up-to-date firmware on your hardware wallet. Manufacturers periodically release firmware updates that contain critical security patches addressing newly discovered vulnerabilities. Failure to apply these updates may leave your device susceptible to exploitation and compromise. Always obtain firmware updates directly from official sources to avoid potential counterfeit versions that could jeopardize your assets.

Wallet security breaches can occur if older firmware versions are targeted by attackers exploiting known vulnerabilities. Therefore, routinely checking for updates and applying them as they become available is a vital practice for safeguarding your assets. Keeping your firmware updated not only enhances security but also ensures the device operates optimally with the latest features and improvements.

Physical Security Measures

Unlike traditional banking, where physical locations may provide security, hardware wallets require individual holders to implement their own physical security measures. It is vital to recognize that the security of your digital assets is only as strong as the physical security of the device storing them. Anyone with access to your hardware wallet can potentially gain complete control over your crypto, making it imperative to safeguard your device against theft, loss, or damage.

Protecting Your Hardware Wallet

To protect your hardware wallet effectively, consider using secure passwords and an added layer of authentication, such as biometric locks or PIN codes. Additionally, keep your hardware wallet in a place that is not easily accessible or identifiable to unauthorized individuals, such as a safe or hidden compartment. Regularly monitor your physical environment and be cautious about who knows where your wallet is stored, as discretion is a key component of your operational security.

Safe Storage Solutions

Above all, using appropriate storage solutions can significantly enhance the safety of your hardware wallet. Investing in fireproof and waterproof safes or specialized storage devices designed specifically for cryptocurrencies can protect against natural disasters and intrusions. Ensure that any storage solution is discreet and does not attract attention, as visible storage can lead to targeted theft.

Hence, taking advantage of various secure storage methods—such as safe deposit boxes or encrypted USB drives—further mitigates risks associated with physical theft or damage. Combining these techniques with a well-thought-out security plan not only provides peace of mind but also ensures that your crypto assets are kept safe from potential threats.

Securing Recovery Information

To maintain the integrity of your cryptocurrency holdings, it is vital to secure your recovery information, specifically the recovery seeds associated with your hardware wallet. These seeds act as a lifeline to your funds, allowing you to regain access in case of device loss or damage. Properly managing and securing this information can prevent unauthorized access and potential loss of assets.

Importance of Recovery Seeds

Along with your hardware wallet, the recovery seed forms a core component of your cryptocurrency security. It is typically a series of words generated during the wallet setup, and anyone with access to these words can control the associated funds. Thus, safeguarding this information is necessary to prevent theft or irretrievable loss of your cryptocurrency assets.

Safe Backup Strategies

Among various backup strategies, creating multiple copies of your recovery seed and storing them in different secure locations is a recommended practice. Using fireproof and waterproof containers, or even bank safety deposit boxes, can enhance security. Avoid storing digital copies of your recovery seed on devices connected to the internet, as this exposes you to hacking attempts.

Backup strategies should also include verifying the legibility and accuracy of your written recovery seed. Store backups in accessible yet secure locations, ensuring they are not readily available to unauthorized individuals. Regularly review and update your backup practices as needed to adapt to any changes in your security landscape.

Recognizing Social Engineering Attack

Keep an eye out for social engineering attacks, which exploit human psychology to gain access to sensitive information. Recognizing warning signs can help crypto holders protect their assets.

Types of Social Engineering Attacks

On understanding the various types of social engineering attacks is vital for effective security. These attacks can take multiple forms, often leading to unintended consequences for crypto investors.

| Phishing | Deceptive emails designed to steal personal information. |

| Spear Phishing | Targeted phishing attacks directed at specific individuals. |

| Pretexting | Creating a fabricated scenario to extract information. |

| Baiting | Offering something enticing to lure the victim. |

| Quizzing | Using disguised inquiries to gather sensitive data. |

Any awareness of these tactics can significantly reduce the risk of falling victim to social engineering schemes.

How to Respond to Potential Threats

Potential threats require immediate and informed action. If you suspect a social engineering attempt, verify the source before taking any further steps. Always double-check links, and do not provide sensitive details without confirmation.

Plus, maintaining a heightened level of caution is important when managing crypto assets. Implementing two-factor authentication and changing passwords regularly can offer additional layers of security. Train yourself to recognize common attack patterns, and ensure that you never share sensitive information over email or phone without proper verification. Proactivity in recognizing and responding to these threats can help safeguard your investments.

To wrap up

From above, it is clear that implementing robust operational security practices is important for hardware wallet users to safeguard their cryptocurrency holdings. By understanding key risks and adopting preventive measures, such as secure key management, strong passwords, and careful device usage, individuals can significantly reduce the likelihood of theft or loss. Regularly updating firmware and remaining vigilant about phishing attacks further enhance security.

Ultimately, hardware wallets provide a secure method for storing cryptocurrency, but the responsibility for protecting these assets lies with the user. Adopting a proactive and informed approach to operational security can lead to increased confidence in managing digital wealth and navigating the cryptocurrency landscape with peace of mind.