Many large holders of cryptocurrency face heightened risks, including kidnapping and extortion. As the value of digital assets rises, so does the threat to personal safety. This blog post explores effective strategies for enhancing personal security, highlighting key measures such as discreet communication, robust surveillance systems, and anonymity practices. By implementing these precautions, holders can mitigate risks and protect their valuable assets from potential threats.

Key Takeaways:

- Large holders should implement multi-factor authentication and secure digital wallets to protect assets.

- Establish a comprehensive personal security plan that includes physical safety measures and emergency protocols.

- Stay informed about potential threats and regularly assess security practices to adapt to evolving risks.

Understanding Crypto Kidnapping

As the adoption of cryptocurrency continues to rise, so does the threat of crypto-related crimes. One of the most alarming threats is crypto kidnapping, where individuals are targeted for their digital assets. These sophisticated attacks often involve obtaining sensitive information about the victim, leading to extortion and potential physical harm. The anonymity of cryptocurrencies can complicate investigations, making it easier for criminals to evade capture.

Overview of Crypto Threats

Crypto threats encompass a range of criminal activities, from hacking exchanges to direct theft from wallets. This landscape becomes even more perilous with the emergence of ransomware attacks, which can lock individuals out of their own assets until a ransom is paid in cryptocurrency. Such threats create a climate of fear, especially among those holding significant amounts of digital currency.

Motives Behind Kidnapping for Crypto

Between financial desperation and organized crime, the motives behind kidnapping for cryptocurrency can vary widely. Criminals may be driven by the potential for large financial gains, as victims with substantial crypto holdings can be pressured into paying large ransoms. Additionally, the difficulty in tracing cryptocurrency transactions further incentivizes these criminal acts, as offenders believe they can operate without fear of legal repercussions.

Crypto kidnappings often reflect a broader trend where the anonymity and security features of cryptocurrencies are exploited by those looking to profit from violent means. In this context, targeting wealthy crypto holders offers criminals a perceived “easy” route to acquire funds quickly. By understanding these motives, potential victims can better prepare and implement security measures against such heinous acts.

Profile of Large Holders

If you are navigating the world of cryptocurrencies, understanding the profile of large holders is vital for identifying potential security challenges. Large holders, often referred to as “whales,” can possess significant amounts of cryptocurrencies, making them prime targets for threats like crypto kidnapping or extortion. Their financial value in assets gives them leverage but also raises their risk profile considerably, as their large balances become public through various market platforms.

Who are Large Holders?

Around the cryptocurrency landscape, large holders are individuals or entities that maintain substantial amounts of digital assets, often exceeding several million dollars in value. These holders can include successful investors, early adopters, institutional entities, and investment funds, all of whom stand out in the crypto economy due to their sizeable investments. Their wealth in crypto raises their visibility, leading to targeted attacks or threats due to their significant financial leverage.

Risk Factors for Large Holders

An extensive array of risk factors impacts large holders in the crypto space. They often face threats such as physical attacks, cybersecurity breaches, and social engineering scams. Additionally, their public exposure from large transactions or accounts may attract unwanted attention from malicious actors seeking financial gain. Understanding these risks is vital for implementing protective measures.

- Physical threats to security.

- Online scams targeting wealth.

- Data breaches leading to financial loss.

- Reputational damage from attacks.

With the increasing popularity of cryptocurrencies, large holders must remain vigilant against a spectrum of threats that can jeopardize their wealth and safety. These risks may not only encompass the aforementioned physical and online dangers but can also involve regulatory scrutiny and market volatility that can impact their investments. Consequently, implementing a robust security strategy is vital for safeguarding their assets and ensuring peace of mind. Knowing that these factors play a significant role in their overall security posture can help large holders navigate the hazardous landscape more effectively.

- Regulatory changes impacting holdings.

- Market trends affecting value.

- Personal privacy at risk due to transparency.

- Technological vulnerabilities needing attention.

Personal Security Strategies

Unlike typical asset management, safeguarding substantial crypto holdings demands a multifaceted approach to personal security. Individuals with significant investments in cryptocurrencies are often prime targets for criminals, necessitating strategies that address both physical and digital vulnerabilities. These strategies must encompass lifestyle adjustments, increased awareness, and a proactive mindset to mitigate risks effectively.

Developing a comprehensive personal security strategy involves assessing one’s environment and interactions. Adopting measures such as utilizing secure passwords, enabling two-factor authentication, and minimizing the sharing of personal information can go a long way in discouraging potential threats and ensuring a safe investment experience.

Physical Security Measures

On the physical security front, individuals should invest in secure living environments, including reinforced doors, surveillance systems, and alarm services. Carrying personal security devices, like pepper spray or personal alarms, can serve as deterrents in case of an emergency. Additionally, fostering a routine that avoids predictable patterns can help in reducing the likelihood of targeted attacks.

Moreover, being vigilant about surroundings and exercising caution in personal interactions are important traits for large crypto holders. Engaging in public discussions about one’s assets can unwittingly attract unwanted attention, so discretion in all matters, notably online and offline, is vital.

Digital Security Practices

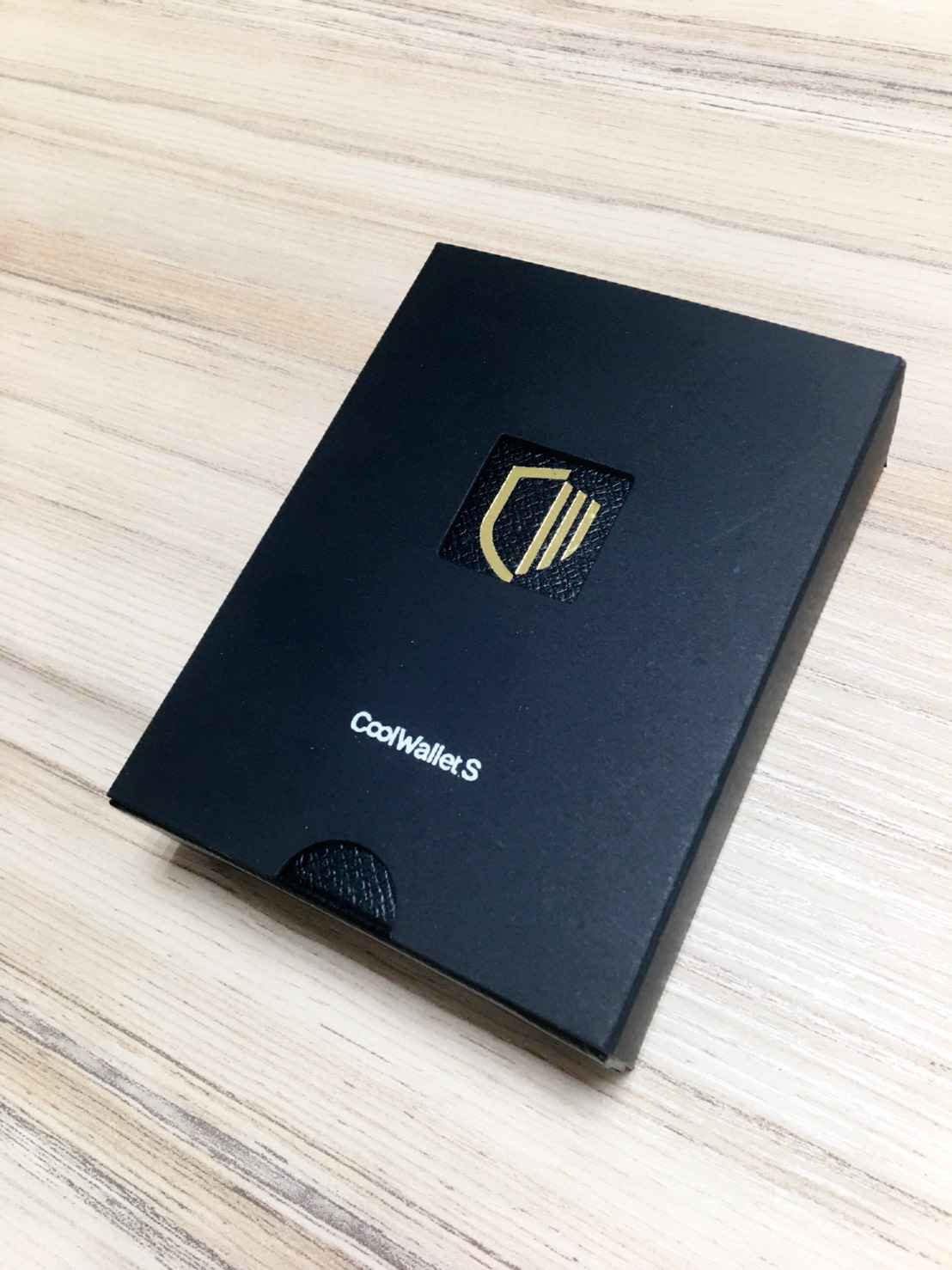

Around digital security, implementing robust encryption methods for sensitive data and making regular software updates are fundamental practices. Utilizing hardware wallets instead of online exchanges significantly decreases the exposure of digital assets to potential cyberattacks. It’s also advisable to conduct periodic audits of digital accounts and security settings.

Indeed, enhancing digital security involves being proactive about phishing attempts and recognizing fraudulent communications. By maintaining an updated knowledge of the latest threats and utilizing resources such as secure VPNs, individuals can create a protective barrier around their digital identities. Strong cybersecurity habits exponentially decrease the risk of falling victim to cybercriminals, safeguarding both personal and financial information with strategic vigilance and ongoing awareness.

Family and Community Awareness

After accumulating significant cryptocurrency holdings, it is vital to promote awareness among family members and the broader community. Individuals with substantial assets must proactively discuss the potential risks and preventative measures associated with their holdings. Increasing understanding can deter potential threats and help create an environment where safety is prioritized.

Additionally, fostering a sense of vigilance within the community can also discourage individuals with malicious intent. Neighborly communication about security practices, combined with a culture of reporting suspicious activities, can create layers of protection around those who may be seen as targets.

Educating Family Members

Among the first steps in enhancing personal security should be the education of family members about the risks associated with large cryptocurrency holdings. This includes discussing the importance of privacy, online safety measures, and how to respond in case of a threat. Family members must be aware that revealing personal information can lead to unwanted attention and potential incidents.

Moreover, teaching family members how to identify and report suspicious behavior can empower them to act as an additional line of defense. Proper training in basic self-defense and emergency response tactics can greatly increase the overall safety of the household.

Building a Support Network

Among the most effective ways to bolster security is by establishing a robust support network that includes trusted friends, family, and local community members. This network serves not only as a source of emotional support but also as a practical safety measure when threats arise. Regular interactions with this group can lead to shared insights, tips, and best practices aimed at enhancing personal security.

The creation of a strong support network can involve setting up regular check-ins to discuss security strategies and updates, organizing community safety events, and collaborating on local initiatives aimed at crime prevention. Such networks can enhance overall vigilance, ensuring that community members look out for each other’s well-being while fostering trust and cooperation among them.

Responding to Threats

Once again, it’s important for large cryptocurrency holders to be prepared for various threats, including potential kidnapping scenarios. A well-thought-out response can make a significant difference. Developing both personal and financial security measures is necessary to mitigate risks while ensuring that a swift and effective response plan is in place.

Once a threat is detected, deploying a tailored action plan can help individuals feel more secure. Having a strategy that outlines precise steps to follow during a kidnapping threat can alleviate panic and confusion, allowing for clearer thinking. This should include safe word communication, designated safe locations, and trusted contacts who are aware of your situation.

Developing an Action Plan

With a well-structured action plan, individuals can enhance their readiness for potential threats. This plan must outline specific protocols, such as how to respond to communication from kidnappers and what information should remain confidential. Regular drills and updates to the plan ensure that everyone involved understands their roles, making the response efficient when needed.

Communication with Authorities

Plan to establish a direct line of communication with local law enforcement and emergency services. It’s vital to keep these contacts informed of your situation before any incident occurs, ensuring their response is swift and informed should a threat arise. Providing them with a profile of your cryptocurrency holdings and potential risks can aid in their preparations.

And maintaining open lines of communication with authorities can significantly influence the outcome of a kidnapping situation. Responding promptly to an incident and sharing critical information can help law enforcement take quicker action. Engaging with trusted law enforcement ensures that they are familiar with your case and can provide tailored advice, resources, or intervention strategies in the event of a crisis. Understand that their expertise can be a lifesaver during these high-pressure moments.

Case Studies and Real-Life Examples

Now, recent incidents highlight the importance of personal security for large holders of cryptocurrency. Several case studies reveal patterns and techniques used by criminals targeting individuals for their crypto assets:

- 2018 Crypto Kidnapping Case in Mexico: A well-known investor was kidnapped and held for ransom of $2 million in Bitcoin, ultimately leading to a police raid and the rescue of the victim.

- 2020 Ransomware Attack on High-Profile CEO: An executive was threatened with doxing after hackers accessed their digital wallets, demanding payment in Ethereum.

- 2021 Kidnapping Ring in India: A group specialized in targeting wealthy individuals, resulting in over $500,000 worth of cryptocurrencies stolen from victims.

Notable Incidents of Crypto Kidnapping

Between 2017 and 2021, multiple high-profile kidnappings have occurred across various regions, involving victims with significant crypto holdings. One notable case involved a prominent blockchain developer who was abducted in an attempt to extract crypto wallet access codes. Another incident involved a family in the U.S. coerced into transferring Bitcoin under threat of violence, leading to alarmed responses from law enforcement and heightened awareness in the crypto community.

Lessons Learned from Past Cases

Learned from these unfortunate incidents, security measures must evolve to address the risks faced by holders of significant cryptocurrency. Comprehensive strategies that integrate kin and home safety protocols, such as location tracking and encrypted communications, help mitigate the risks associated with being a cryptocurrency investor.

Understanding the patterns of these incidents allows potential victims to enhance their security system strategies. Implementing advanced safety protocols such as changing communication methods, securing homes with surveillance, and engaging local authorities can significantly reduce risks. Moreover, prioritizing discretion and maintaining a low profile regarding crypto holdings can deter potential kidnappers. By recognizing these dangers and taking proactive steps, individuals can protect themselves and their assets effectively.

Summing up

Summing up, the rise of cryptocurrency has brought new security challenges, particularly for large holders who face the risk of crypto kidnapping. Implementing robust personal security measures is necessary to safeguard against these threats, including physical security training, maintaining a low profile, and utilizing secure communication channels. Additionally, having a well-thought-out emergency plan can make a significant difference in ensuring safety.

As the landscape of digital assets evolves, it is imperative for large holders to stay informed about potential risks and to establish a comprehensive strategy for personal security. Engaging with professional security firms and adopting advanced protective measures will provide peace of mind and help mitigate the dangers associated with crypto wealth, ultimately enabling individuals to continue managing their assets securely.

FAQ

Q: What measures can large cryptocurrency holders take to protect themselves from potential kidnappings?

A: Large cryptocurrency holders should consider implementing a multi-faceted security approach, including risk assessment, personal security training, and employing professional security personnel. Utilizing secure storage solutions for digital assets, such as hardware wallets, and ensuring limited public exposure can also enhance safety.

Q: How can anonymity be maintained while managing substantial cryptocurrency assets?

A: To maintain anonymity, large holders should avoid sharing personal information in public forums and consider using pseudonyms when conducting transactions. Engaging in privacy-focused cryptocurrency networks and utilizing services that support anonymity, such as mixing services, can further safeguard their identity.

Q: What role does technology play in preventing crypto-related kidnappings?

A: Technology can enhance security through advanced surveillance systems, GPS tracking, and secure communication channels. Implementing biometric security measures and using encrypted messaging applications can help protect personal information and ensure that large holders remain safe from potential threats.